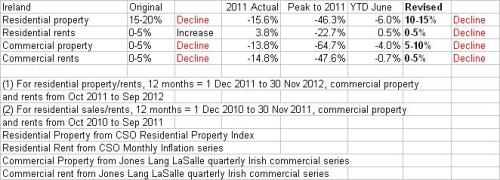

We now have the main indices for Irish residential and commercial property prices and rents for the first six months of 2012, and it might be helpful to take stock of trends and the outlook for the remainder of the year. The predictions on here for 2012 were published at the end of December here, and are shown below ? marked ?original? ? along with the actual results for 2011, declines from peak to the end of 2011, the mid-year 2012 actual outturn and revised forecast for the full year 2012.

It now seems on here that the decline in residential property will be less than originally predicted and the revised prediction is a 10-15% decline ? the late introduction of the House Price Database and the absence of any detail yet on the new property tax and lower interest rates are contributory reasons for the reduction in the forecast from a 15-20% decline.

The severe reductions in rent assistance by the Department of Social Protection in January 2012 are the main reason for revising residential rent and the revised prediction is a 0-5% decline. The original prediction based on the 2011 trend was a 0-5% increase.

Despite the giveaway budget last December 2012, commercial property has performed worse than expected and the revised prediction is a 5-10% decline. Scarcity of credit and poor European and Irish economies have contributed to the revision from the original 0-5% decline.

The commercial rents prediction remains unchanged at a 0-5% decline. Despite claims of prime rents stabilising, there is an acute oversupply of non-prime property, and this property is being offloaded onto the market dragging rents down.

Main developments in January-June 2012

Europe is still in crisis, for a small exporting nation, we depend on a healthy Europe to support our economic advance. Forecasts of economic growth in the EuroZone and in the UK have been cut, and as I write this today, both Spain and Italy are on the brink of seeking bailouts which are beyond the capacity of the European bailout fund, which is facing a challenge in Ireland?s Supreme Court today and may also be de-railed by German constitutional court challenges, decisions on which are expected at the start of September 2012. For the first six months of this year, Europe has lurched hopelessly from one crisis to the next, with the core problem of sovereign, personal, corporate and banking debt still not being addressed.

Economic forecasts are worse, the Department of Finance forecast for GDP and GNP at the start of this year was 1.3% and 1%, the official forecast for GDP is now 0.7% and although there was no Department of Finance forecast in the April 2012 Stability Propgramme Update, the consensus is that we will have modestly negative GNP this year. GDP and GNP both declined in the first quarter of 2012 by 1.1% and 1.3% respectively. Unemployment is now at a record in this crisis of 14.9% and the job announcement ?spectaculars? have been more than offset by the drip-drip erosion of employment. Construction and retail have suffered in particular, though there have been some bright spots, with Exchequer targets being met, service sector activity growing, exports up in the first quarter and consumer confidence showing signs of stabilisation.

Rent assistance reductions that were announced in January 2012 were more severe than expected on here. The average reduction was 13% with the highest at 29%.

Interest rates are trending downwards ? against expectations on here ? the ECB has reduced its main interest rate by 0.25% from 1% to 0.75% which means that nearly half Ireland?s mortgage borrowers have benefited from immediate reductions to their tracker rates, whilst variable rates have also trended downwards. Having crossed the 1% Rubicon in July, the ECB may again cut rates during the remainder of this year.

Credit availability is more restricted, although we?re still awaiting the mortgage figures for the second quarter of 2012, the results for quarter one were dreadful. Finance for commercial property isn?t any better with Bank of Ireland, and to a lesser extent Barclays being the only lenders of note into the sector. NAMA has committed ?2bn for staple finance which might help (NAMA?s) commercial property prospects going forward.

?

Expected developments in July-December 2012

Property tax, although hard data is suspiciously hard to come by from Phil Hogan?s Department of Environment , Community and Local Government, it seems that 40-50% of households still haven?t paid the ?100 household charge, even four months after the 31st?March 2012 deadline. We can quibble about the level of compliance, but it seems that there has been massive resistance to the new charge. We know that the so-called expert report on the shape of a new property tax to take effect from the start of 2013, has been recently delivered to Cabinet, but we don?t yet have any detail, though there is much anxiety amongst home owners that they may face an average annual charge in 2013 of hundreds of euro if not ?1,000. Given the requirement under the Troika memorandum to raise over ?1bn in new taxes in 2013 and with options on income tax and social welfare rates apparently taken off the table, with VAT and excise taxes already at elevated levels, it is likely that any average new property tax be in the ?300-700 range. Increasing the cost of home ownership should logically mean a reduction in home values.

House Price Database (register), Tom Lynch, the CEO at the Property Services Regulatory Authority says that we will have hard sales price data from September 2012, and we may even get data going back to 2010. In a buyers market, the new register should have the effect of beating down prices because buyers with the upper hand will automatically seek the lowest price based on similar property sales.

Europe, this is the wildcard because on one hand, if the EuroZone decides to abandon the 2% annual inflation target and print more money, then we might see inflation rising which will mean property prices increase. On the other hand, the EuroZone crisis may intensify, undermining growth and leading to further asset depreciation. Or the status quo of a slow brownout may continue. A wildcard.

More NAMA supply, NAMA?s residential property portfolio of 13,000 Irish homes worth about ?2.5bn is not market-moving but it is still significant and at some point these homes will need come on the market if NAMA is to have its loans repaid, NAMA may rent rather than sell for the time being however. NAMA?s commercial portfolio, worth about ?6bn is significant in a market which was worth less than ?0.5bn in 2011. Over supply of vacant commercial property is still a major problem generally, though there are noted shortages in some locations for some types of property. NAMA might prefer to rent rather than sell, but the degree of oversupply is such that we can expect some NAMA property to come onto the market for sale.

Budget 2013, last year?s budget was the most commercial property-friendly budget in (my) living memory, with stamp duty slashed from 6% to 2%, with the abandonment of Upward Only Rent Review reform and capital gains tax incentives. Alas, the experience of the first six months demonstrates that more is needed to get the commercial property market moving. NAMA has a market-moving portfolio of commercial property-related loans and we might assume that Minister Noonan will give NAMA a willing ear for any proposed changes to the tax/regulatory environment. You can probably expect an extension of incentives for residential property also, though of course these will not be announced in advance lest they lead to a deferral of existing purchases.

Source: http://namawinelake.wordpress.com/2012/07/24/10933/

new smyrna beach st. joseph walking dead puerto rico primary manning peyton florida state

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.